'Guilty until proven innocent': Inside the fight between doctors and insurance companies over 'downcoding'

Doctors say that insurers are automatically downgrading their claims and paying less. Fighting back takes time and money — and could hurt patient care in the end.

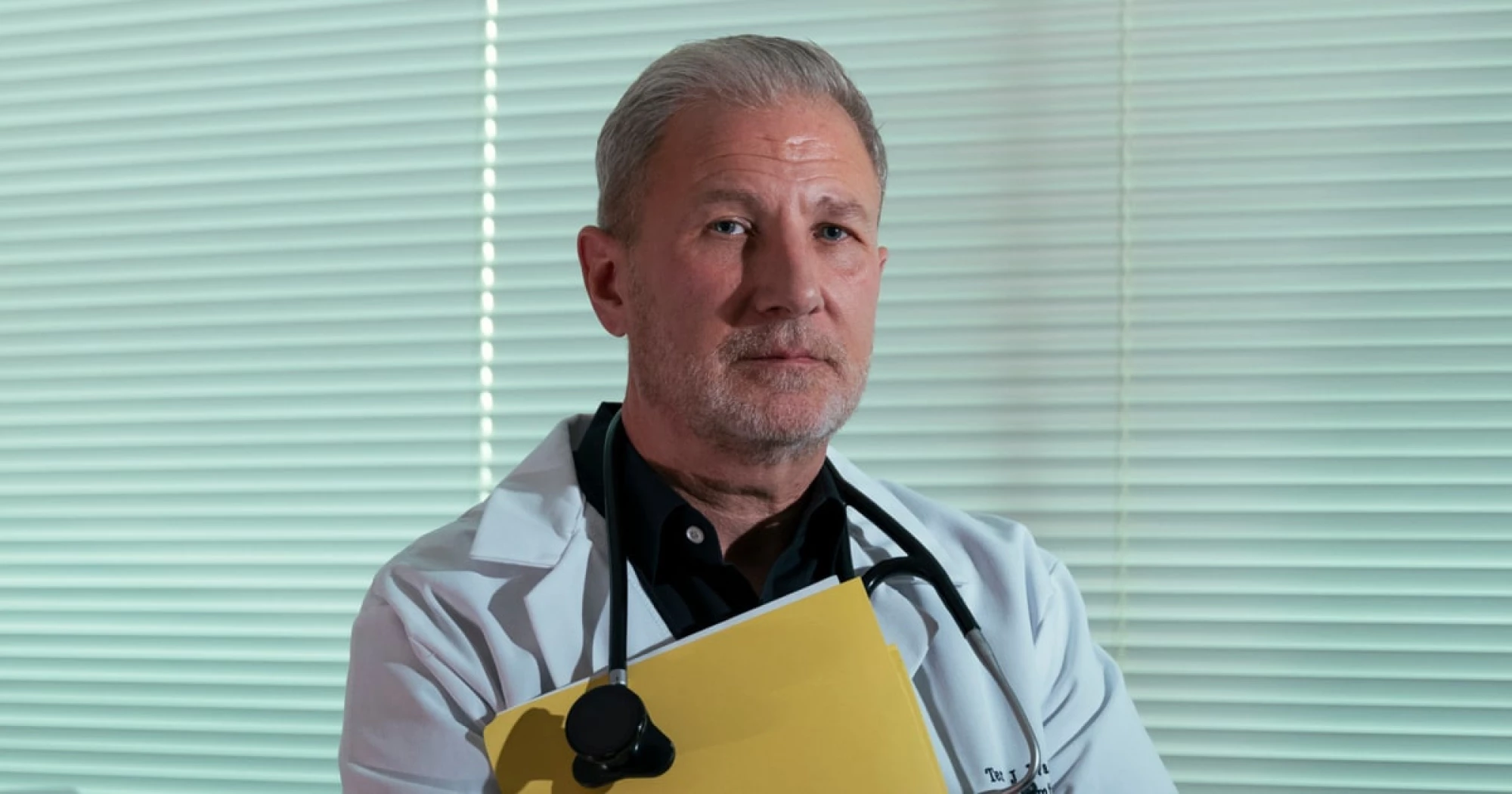

In the beginning of the year, Dr. Terry Wagner’s office manager came to him and said “something weird is going on.”

For weeks, the office manager told him, Wagner had been quietly underpaid by the insurance company Aetna on a seemingly random selection of higher level claims.

“It’s blatantly disrespectful,” said Wagner, a family medicine doctor who has run a small practice in Hudson, Ohio, for the last 28 years. “It’s not like they came back to us saying, ‘Hey, we need more information,’” he said, adding that Aetna just paid the claims as if they’d been billed for a lower level of service.

It’s a practice called “downcoding.” Insurance companies — in Wagner’s case, Aetna — automatically downgrade the claims a doctor sends them to a lower tier of reimbursement, without actually reviewing details about the visit itself.

For Wagner, that means a “level four” office visit that might yield $170 is being paid as if it’s a “level three” for about $125. That $45 difference might not seem like much, but when it’s happening on dozens of claims, and to a physician-owned practice like Wagner’s, the damage mounts. “This can really hit a small company hard, especially if you’re not catching it,” he said.

Rating: 5